Monetary Policy Monetary Policy Easy Definition Quizlet

What is Tight Monetary Policy?

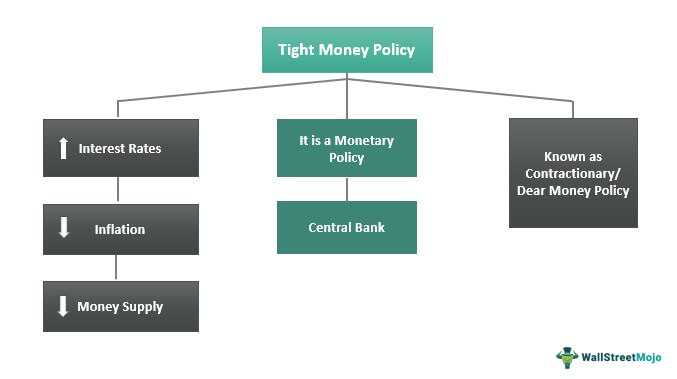

The tight monetary policy refers to the action taken by the central bank to bring down inflation by reducing the money demand and supply in the economy. It involves measures like upsurging the interest rates, selling government securities, and increasing the banks' reserve requirements to slow down overheated economic growth caused due to accelerating spending.

It is also called contractionary or dear monetary policy. The prime purpose of adopting this policy is to curtail the consumers' and companies' purchasing power by increasing the borrowing cost. As the people tend to spend less on goods and services due to this policy, the demand falls. It leads to a slowdown in economic inflation.

Table of contents

- What is Tight Monetary Policy?

- Tight Monetary Policy Explained

- Loose vs Tight Monetary Policy

- Tools

- Examples

- Example #1

- Example #2

- Effects

- Advantages

- Disadvantages

- Frequently Asked Questions (FAQs)

- Recommended Articles

- The tight monetary policy is a tool a nation's central bank uses to decelerate economic inflation by downsizing the money supply in the economy.

- It emphasizes implementing the three prominent contractionary monetary measures, i.e., escalating the open market operations like selling government-issued securities, raising the discount rate, and increasing the reserve requirement.

- Such measures decrease the consumers' purchasing power, lowers consumption and production of goods and services, and slow down the economy in the long run.

- Some adverse effects of monetary policy tightening include higher unemployment and a decline in the nation's economic growth.

Tight Monetary Policy Explained

You are free to use this image on your website, templates, etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Tight Monetary Policy (wallstreetmojo.com)

The implication of tight monetary policy is to bring down inflation by limiting the circulation of money in the economy. It makes money more expensive to borrow by increasing short-term interest rates. Thus, a nation's central bank takes corrective action to save the economy from slipping into hyperinflation. A high rate of inflation results in rising prices of goods and services, overvaluation of stocks, and higher speculative practices as the purchasing power of money fall further.

The central bank of the United States, the Federal Reserve Bank (Fed), regulates the money supply in the U.S. The money supply refers to the total amount of money in circulation. As money supply increases, demand increases, and invariably, price increases leading to inflation. Increasing demand raises input costs and the wages of the workers. As a result, the workers consume more. It acts like a chain reaction and overheats the economy.

Boosted interest rates curb money flow between individuals and banks, reducing credit. It absorbs extra capital from an economy. As the central banks increase their overnight interest rates, commercial banks borrow less money from them to lend it to the borrowers, i.e., the consumers and enterprises, as investments. Thus, money becomes more expensive and less accessible. It affects borrowings such as personal loans, interest rates on credit cards, and mortgages.

Loose vs Tight Monetary Policy

A loose or easy money policy is the opposite of a tight money policy. When deflation occurs, the growth rate slows, overall consumer demand in the economy reduces, and price levels decrease. As production declines, the firms lay off their workers and stop further investments. The foreign exports may also fall. Therefore, adopting an expansionary policy becomes essential to minimize it.

The central bank may follow an easy monetary policy to boost the country's economic activity. But the same bank may pursue a contractionary or tight money policy if the inflation rises and the government wants to keep it under control.

Tools

The central bank of any country adopts the following three measures for the implementation of the tight monetary policy:

- Raising Discount Rates Or Short-Term Interest Rates: An increase in the rate at which the commercial banks borrow funds for the short-term from the central bank makes the loans and short-term debts expensive for these banks. Banks then charge a higher interest from their clients.

- Upsurging Banks' Reserve Requirement: The central bank prescribes a minimum reserve limit that the commercial banks have to keep with the former to remain eligible to function as a bank. Commercial banks are left with less working capital when this minimum reserve requirement increases.

- Increasing Open Market Operations: The Federal Reserve also sells government-issued bonds and securities. It encourages people to invest or save more and spend less. Thus, less disposable income is left to consumers to buy the goods and services.

In the U.S., if the inflation rate upsurges over the average rate of 2%, the Federal Reserve imposes contractionary monetary measures to attain price stability by deteriorating the consumers' disposable income or purchasing power. However, one of the prime drawbacks of tightening the money supply in the economy is rising unemployment. It increases due to a decline in the consumption and production of goods and services.

Examples

Example #1

The inflation of the 1980s is one of the primary tight monetary policy examples.Due to economic overheating, inflation was rising rapidly in the U.S. It reached 13.50%. The unemployment rate increased from 7-8% in 1980 to 10.8% in 1982. The government used a tight money policy to reduce the inflation rate and slow the rising prices.

Example #2

The inflation rate in the U.S. has gone up by almost three times its average rate of 2%. It is a prime concern and an alarming condition for the Federal Reserve. Thus, on May 3-4, 2022, the Federal Reserve raised the interest rates by half percent in the U.S. to bring down the price inflation across the U.S.

Although, there is an expected further rise in this interest rate by June and July 2022, assessing it to be between 2% to 3%. To prevent the U.S. economy from slipping into recession, the Federal Reserve would likely halt these contractionary measures by September, when the interest rate will reach somewhere between 1.75% and 2%. The Fed will then focus on analyzing the impact of this monetary tightening on employment and inflation. However, the tight monetary policy may decrease the percentage of the U.S. Treasuries yields.

Effects

The contractionary monetary policy facilitates the central bank to revive an inflation-struck economy. However, its implementation is well-planned and structured since such measures have a long-lasting and muti-dimensional impact on the economy.

The tight monetary policy has its advantages and disadvantages. Therefore, central banks may adjust their economic policies in response to the economy's demands. Given below are the various positive and negativetight monetary policy effects:

Advantages

- Controls Inflation: The tightening of the economy's money supply primarily aims to reduce inflation and ensure the price stability of goods and services.

- Encourages Savings And Investment: Speeding up the open market operations by selling the government-issued bonds and securities to the public motivates them to invest in government securities and save more money. So, bond prices that provide fixed rates of interest decrease.

- Encourages Efficiency:Reducing export demand leads to a decline in aggregate demand. However, it can encourage firms to produce more efficiently and cut costs as competitiveness decreases.

- Eases Implementation:A change in monetary policy is preferred over a fiscal policy as legislation takes a long time to become law and implement spending adjustments.

Disadvantages

- Reduces Purchasing Power of Consumers: As the minimum reserve requirement rises, the commercial banks have less money to offer as loans to the customers. It shrinks their purchasing power.

- Makes Short-Term Borrowings Expensive: With an increase in the discount rate, commercial banks charge higher interest rates on short-term loans and advances from their customers.

- Limits Consumption: Consumers with low disposable incomes spend less on purchasing goods and services.

- Decreases Production: Since the demand for goods and services falls due to the narrowing of the consumers' purchasing power, the companies have to downsize their production accordingly.

- Increases Unemployment: As a result of low consumption, the sales of goods and services also decline. Thus, the companies lay off employees to cut expenses.

- Decelerates Economic Growth: Since all the measures focus on curtailing the money circulating in the economy, there is a decrease in consumption and sales of goods and services. It results in lower profitability of the business entities. Also, the banks don't have sufficient funds to extend loans to their clients.

- Increases Exchange Rates:It leads to a decrease in exports and an increase in imports. As a result, exchange rates rise, and the balance of payments decreases.

Frequently Asked Questions (FAQs)

What does a tighter monetary policy mean?

Thetight monetary policy meaning describes the contractionary measure adopted by the Federal Reserve to curb the inflation level in the economy. It aims at limiting the money supply in the economy to scale down the purchasing power of the consumers and firms.

How does a tight and loose monetary policy affect interest rates?

Tight monetary policy increases the interest rates making money more expensive to borrow. In contrast, the loose monetary policy reduces the interest rates making money easily accessible for lending and borrowing.

Which one is better expansionary or contractionary monetary policy?

Implementation of the expansionary or contractionary monetary policy depends on the economic scenario. The function of each of these policies is different. They regulate the money supply in the economy to bring down inflation or accelerate a slowed-down economy. So, both these policies equally help in reviving the economy.

What is the difference between tight and easy monetary policy?

The tight monetary policy involves the implication of contractionary measures to cut down the money supply in the economy to control inflation. In contrast, the central bank undertakes the expansionary or easy monetary policy to pump additional money supply into the economy to fight the economic slowdown.

Recommended Articles

This has been a guide to Tight Monetary Policy and its definition. We explain its implication, tools, effect, examples, advantages, and disadvantages. You may learn more from the following articles –

- Accommodative Monetary Policy

- Contractionary Monetary Policy

- Monetary Base

Source: https://www.wallstreetmojo.com/tight-monetary-policy/

0 Response to "Monetary Policy Monetary Policy Easy Definition Quizlet"

Post a Comment